Nippon Steel hires Mike Pompeo to advise on U.S. Steel deal

Nippon Steel has proposed a $14.9 billion merger with U.S. Steel, aiming to create a stronger entity within the global steel industry. The merger has received all necessary regulatory approvals outside of the United States but faces significant political opposition and regulatory scrutiny domestically.

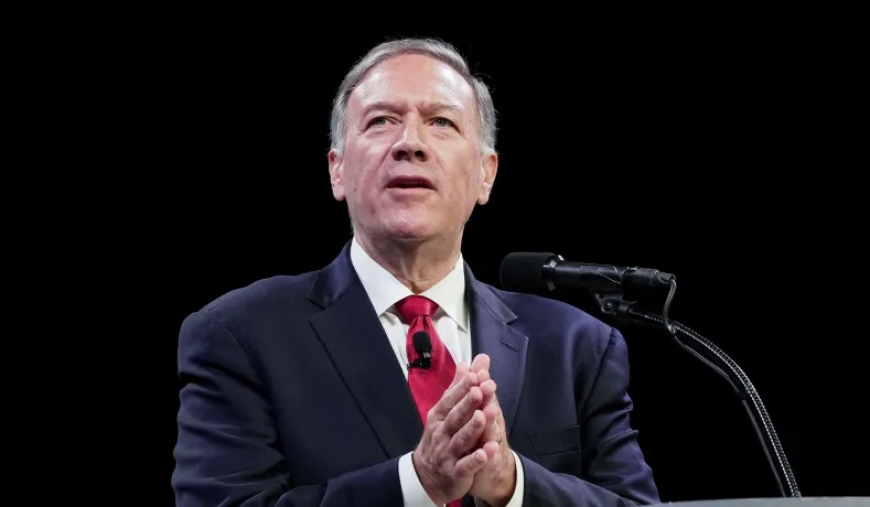

Japan's largest steelmaker, Nippon Steel Corp., has announced the hiring of former U.S. Secretary of State Mike Pompeo as an adviser to assist with its bid to acquire U.S. Steel (X.N). The Japanese company revealed this strategic move on Saturday, emphasizing Pompeo's role in bolstering the acquisition's narrative around economic and national security benefits for the United States.

Mike Pompeo, who served as Secretary of State under former President Donald Trump, has been brought on board as an adviser to Nippon Steel.

Although he has not been assigned a specific job title within the company, Pompeo's involvement is expected to leverage his extensive experience and bipartisan respect to navigate the complex political landscape surrounding the acquisition.

"We look forward to working alongside him to further emphasize the ways in which Nippon Steel's acquisition of U.S. Steel bolsters the country's economic and national security," Nippon Steel said in a statement to Reuters.

Nippon Steel has proposed a $14.9 billion merger with U.S. Steel, aiming to create a stronger entity within the global steel industry. The merger has received all necessary regulatory approvals outside of the United States but faces significant political opposition and regulatory scrutiny domestically.

Both former President Donald Trump and current President Joe Biden have expressed intentions to block the deal.

The powerful United Steelworkers (USW) union has also voiced objections, concerned about potential job losses resulting from the merger. Nippon Steel has pledged to honor existing agreements between U.S. Steel and the USW while offering additional commitments to mitigate union concerns.

Takahiro Mori, Nippon Steel’s Vice Chairman and key negotiator for the deal, visited the United States this month. His visit included tours of U.S. Steel facilities and meetings with stakeholders and employees to address concerns and build support for the merger.

Industry and Economic Implications:

The merger, if successful, would position Nippon Steel as a more formidable competitor in the global steel market, currently ranking as the world's fourth-largest steelmaker.The consolidation aims to enhance operational efficiencies, expand market reach, and strengthen the combined entity's ability to innovate and compete internationally.

Nippon Steel emphasizes that the acquisition would support U.S. economic and national security interests by ensuring a stable supply of steel, a critical material for infrastructure and defense.Nippon Steel's hiring of Mike Pompeo signals a robust strategic effort to overcome the political and regulatory hurdles in the United States. With Pompeo's guidance and the company's ongoing negotiations with stakeholders, Nippon Steel aims to secure the necessary approvals and support for the merger.

As the situation evolves, stakeholders and industry observers will closely watch how Nippon Steel navigates the challenges ahead, leveraging its strategic hires and commitments to push the merger forward. This development underscores the complexities of international acquisitions and the significant role of political and economic considerations in such high-stakes transactions.

LD Web Desk

LD Web Desk